Being a college student means having a lot on your plate. Going to classes, becoming involved in extracurriculars, holding down an on-campus job, writing eight-page papers into the wee hours of the morning, you get the idea. With all these commitments, maintaining a solid credit score is probably the last thing on your mind right now.

However, it's crucial because it can hurt your financial future. Negative scores lead to weak credit reports, which severely reduce your chances of securing a loan or moving into that cute little off-campus apartment you like. Now odds are you, like so many other students, don't have credit history. That doesn't mean you shouldn't know what your FICO® score is and how you can build it.

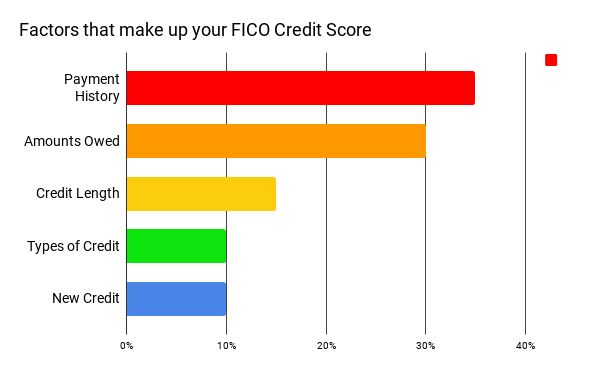

FICO® scores are determined through an algorithm that takes five factors from your credit report into consideration. The total score tells lenders whether or not they can trust you to make timely payments. The higher your score, the better. Let's take a closer look at each factor and what you can do to improve them.

CREDIT MIX {10%}

While this particular factor is not critical in determining your score, it can be beneficial to know about it. Credit mix is the combination of credit cards, accounts, and loans you have, and will help calculate a score in the event there is not enough information.

NEW CREDIT {10%}

Don't dismiss this factor because it makes up a small percentage. Opening multiple credit accounts in your name indicates you are either currently or at risk of being in financial trouble.

AMOUNTS OWED {30%}

The one problem area FICO® keeps an eye on is the percentage of a person's credit, which is how much you owe divided by the maximum amount of credit you have available. It enables them to see if a person has made late or missed payments or makes a habit of maxing out credit cards. Looking to avoid this? Maintain a low balance and spend no more than thirty percent of your credit limit.

PAYMENT HISTORY {35%}

The most significant of the five, payment history allows FICO® to address the lender's main concern: Will they pay on time? By looking at past bills and recognizing if any payments or collections were late, they can determine what your future payment behavior will be.

CREDIT HISTORY LENGTH {15%}

You may not have any credit history, but starting to build it now can make a big difference to your score. The older your account gets and the more credit you use, the higher your score will become and the better your financial behavior has a chance of looking in the long run.

Borrowing small amounts of money like borocash and repaying on time could help raise your credit score and set you up for a successful financial future. Get up to $2000 and pay back over time with no credit history required. Learn more and apply now at getboro.com/cash.